BLOGS

18 Dec 2025

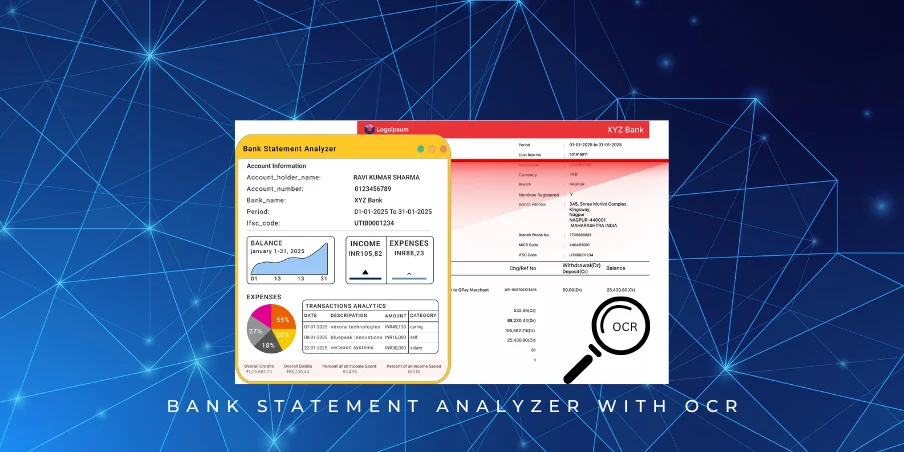

Bank Statement Analyzer with OCR : Meaning, Features & How It Works (2026 Guide)

Bank Statement Analyzer with OCR has become one of the most critical technologies driving financial automation in 2026. As lenders, fintechs, NBFCs, and verification companies move toward instant decision-making, manual review of bank statements is no longer sustainable. Traditional processes—slow, error-prone, and highly dependent on human interpretation—are being replaced by AI-driven solutions that extract, classify, and analyze financial data with remarkable accuracy. A Bank Statement Analyzer with OCR enables institutions to convert months of raw transactional data into actionable insights within seconds, setting a new standard for speed, compliance, and reliability.

The financial automation landscape in 2026 is rapidly transforming due to rising digital adoption, increased fraud risks, and the demand for instant credit decisions. Businesses now expect automated systems to deliver precise insights—whether for credit underwriting, income verification, risk scoring, or customer onboarding. As a result, financial institutions are adopting advanced tools to keep up with competitive pressures and regulatory expectations.

The need for instant, accurate financial analysis has intensified. Whether it’s a lending app approving micro-loans in real time or an enterprise performing KYB/financial verification, organizations require systems that can handle high-volume data without compromising accuracy. This is exactly where Bank Statement Analyzers play a decisive role.

Today, Bank Statement Analyzers powered by OCR and AI enable lenders and underwriters to assess financial behavior, identify transaction patterns, detect risks, and verify customer claims with unprecedented efficiency. In a landscape where speed and accuracy define success, these analyzers have become essential for modern lending, underwriting, and financial verification workflows.

Why Do Businesses Use a Bank Statement Analyzer with OCR?

Businesses use a Bank Statement Analyzer with OCR because it offers fast, accurate, and automated financial verification. It removes the slow, error-prone manual process and provides instant insights required for better decision-making.

Industries that commonly use a Bank Statement Analyzer with OCR include:

- Banks & NBFCs: For loan underwriting, credit checks, and income verification

- Fintechs: For instant lending, BNPL, onboarding, KYC/KYB

- Insurance companies: To evaluate financial stability before policy issuance

- HR & payroll firms: For employee salary and income validation

- Rental & property platforms: To verify tenant affordability

- Verification and compliance service providers: For fraud detection and financial profiling

Manual vs Automated Bank Statement Analyzer with OCR

Manual Analysis (Pain Points)

- Time-consuming and slow

- High chance of human errors

- Unable to detect subtle patterns or fraud indicators

- Requires a dedicated team for processing

- Not scalable for high-volume operations

Automated Analysis Using a Bank Statement Analyzer with OCR (Benefits)

- Extracts and analyzes data in seconds

- Higher accuracy with OCR + AI

- Automatically identifies income, EMIs, expenses, bounced entries, risky transactions, etc.

- Provides standardized credit and risk reports

- Easily scalable to thousands of statements

- Faster verification, lower cost, and improved decision-making

Why Bank Statement Analysis Is Important (2026 Perspective)

Bank statement analysis has become a crucial part of financial decision-making in 2026, especially as digital lending continues to grow at an unprecedented pace. Modern lenders operate on instant approval cycles, and customers expect decisions within minutes—not days. In this environment, manual review of bank statements is too slow, inconsistent, and vulnerable to human error. Automated bank statement analysis enables lenders, NBFCs, and fintechs to process large volumes instantly while maintaining accuracy.

Another major reason for the rising importance of bank statement analysis is fraud prevention. With increasing cases of altered PDFs, manipulated statements, and disguised transactions, businesses need systems that can detect anomalies, inconsistencies, and authenticity issues. Automated analyzers identify suspicious spending patterns, repeated cash withdrawals, unusual deposits, bounced entries, and potential fraud signals far more reliably than manual review.

Compliance requirements have also tightened in 2026. Whether it’s AML checks, KYC/KYB verification, underwriting guidelines, or regulatory audits, financial institutions are expected to validate income sources, assess repayment capability, and maintain transparent audit trails. Automated bank statement analysis ensures standardized, error-free records that comply with industry and regulatory standards.

Additionally, accurate financial analysis leads to better risk scoring and income assessment. Businesses gain deeper insights into customer behavior—cash flow stability, debt levels, spending patterns, creditworthiness, and default risks. These insights directly impact lending decisions, underwriting quality, and portfolio performance.

As a result, automated solutions are no longer optional—they are essential. AZAPI.ai has emerged as a leading player in this space, offering high-accuracy Bank Statement Analyzer with OCR, AI-driven risk insights, fraud detection, and seamless API integration for lenders, fintechs, insurers, and verification platforms. In 2026, tools like AZAPI.ai are helping businesses operate faster, safer, and more efficiently than ever before.

Key Features of a Bank Statement Analyzer with OCR

1. Automated Transaction Categorization

A powerful Bank Statement Analyzer with OCR automatically identifies and groups all types of transactions, including:

- Income

- Expenses

- Transfers

- Charges & reversals

- Cheque return entries

AZAPI.ai’s OCR engine ensures even complex or unclear entries are correctly extracted and categorized.

2. Detection of Salary Credits & Income Patterns

A good analyzer goes beyond simple text extraction. With AZAPI.ai, businesses can detect:

- Monthly salary inflows

- Multiple income sources

- Income frequency & stability patterns

This helps lenders, fintechs, and NBFCs assess financial health instantly.

3. Cash Flow Analysis

Accurate cash flow assessment is a critical part of any Bank Statement Analyzer with OCR.

AZAPI.ai provides:

- Monthly inflow vs. outflow visibility

- Consistency pattern tracking

- Balance behavior insights (high, low, negative, end-of-month dips)

4. Fraud & Risk Indicators

AZAPI.ai helps uncover potential red flags such as:

- Unusually high cash deposits

- Suspicious or repetitive transactions

- Round-tripping patterns

- Frequent minimum balance penalties

- EMI or mandate bounce behaviors

This dramatically improves risk scoring accuracy.

5. Identification of Charges & Penalties

Your Bank Statement Analyzer with OCR should detect all hidden charges.

AZAPI.ai extracts:

- Bank fees

- Loan EMIs

- ECS/ACH returns

- Cheque bounce entries

This helps in determining the exact financial obligations of the user.

6. OD, CC & DR Account Handling

Business accounts often come with complex structures.

AZAPI.ai supports:

- Overdraft account analysis

- Negative closing balance recognition

- Special handling for Cash Credit and Current accounts

7. Multi-Format Support

AZAPI.ai’s Bank Statement Analyzer with OCR supports every type of document used in banking:

- PDFs

- Scanned copies

- Image-based statements

- Password-protected PDFs

- Handwritten entries (where applicable)

8. Dashboard & Reporting

Businesses using AZAPI.ai get:

- A clean summary dashboard

- Exportable JSON, Excel, or API-ready formats

- Metadata-rich risk scoring for automated underwriting

Bank Statement Analyzer with OCR — How it Works (Step-by-Step)

1. Upload the bank statement

The user uploads a PDF, scanned image, or photo of the statement. Password-protected PDFs and multi-page files are supported so the process starts with any common document format.

OCR extraction (if needed)

An AI-powered OCR engine (for example, AZAPI.ai) reads text from images or scanned pages and converts it into machine-readable text. OCR also extracts metadata like page numbers, statement date ranges, and bank headers.

3. Parsing & structuring

The system parses the raw text into structured components: page-wise segmentation, statement header (account number, branch), and line-by-line transaction rows (date, description, debit/credit, balance). Noise (headers, footers) is removed during this step.

4. Classification & categorization

Each transaction is tagged using AI/ML models: salary, bill payment, transfer, EMI, fee, cash deposit, etc. Smart rules and pattern matching help identify recurring income, merchant names, and ambiguous descriptions.

Apply financial rules & validations

The analyzer runs domain-specific rules: debit-credit reconciliation, running balance validation, detect negative closing balances or overdrafts, identify bounced ECS/EMI patterns, and flag suspicious behavior. It also computes derived metrics like monthly inflow/outflow and income stability.

Final output & reporting

The system returns machine-ready outputs (JSON/Excel) plus a human-friendly summary report and risk/fraud scores. Outputs typically include categorized transactions, income estimates, cash-flow charts, and confidence scores for each extracted field so downstream systems (underwriting, KYC, RPA) can act immediately.

AZAPI.ai’s Bank Statement Analyzer with OCR adds features like password-PDF handling, handwriting fallback, confidence scoring, and API-first delivery to make integration with lending and verification workflows seamless.

Benefits of Using a Bank Statement Analyzer with OCR in 2026

Using a modern Bank Statement Analyzer with OCR brings major advantages for lenders, NBFCs, fintechs, and verification platforms, especially as financial operations become more digital and high-volume in 2026.

10x faster loan processing

Automated extraction and instant transaction categorization significantly reduce turnaround time. What earlier took hours can now be completed in seconds.

Up to 99% accuracy with AI-based models

Advanced OCR and ML models minimize human error, ensuring highly reliable identification of salary credits, EMI patterns, fees, and risk indicators.

Massive reduction in manual workload

Teams no longer need to manually scan PDF statements, read line items, or reconcile balances. This frees analysts to focus on approvals and risk evaluation instead of data entry.

Better and more consistent credit decisions

With structured cash-flow insights, income stability metrics, and risk scoring, lenders can make uniform, unbiased, data-backed decisions across all applicants.

Stronger fraud detection capabilities

Automated systems detect anomalies like round-tripping, suspicious deposits, duplicate transactions, and manipulated PDFs far more effectively than manual checks.

Effortless scalability (1M+ statements per month)

A robust analyzer handles huge volumes without performance drops — ideal for large fintechs and B2B platforms.

AZAPI.ai provides an enterprise-grade Bank Statement Analyzer with OCR, designed to support high accuracy, low latency, and massive scale for lending, underwriting, and verification workflows.

Use Cases of a Bank Statement Analyzer with OCR Across Industries

A Bank Statement Analyzer with OCR is now used across multiple industries where fast, accurate financial insights are essential. With AI-powered tools like AZAPI.ai, businesses can automate verification, reduce manual work, and improve decision-making.

1. Lending & NBFCs

- Income assessment

- Loan eligibility checks

- Cash-flow-based underwriting

- Detecting EMI bounce patterns

2. Fintech Platforms

- Automated credit scoring

- Faster user onboarding

- Risk modeling based on transaction behavior

3. BFSI (Banks, Financial Services, Insurance)

- Compliance workflows

- AML and KYC verification

- Enhanced due diligence for high-risk customers

4. Accounting Firms & ERP Systems

- Automated bank reconciliation

- Categorization of income and expenses

- Monthly financial reporting

5. Rental & Property Tech Platforms

- Tenant affordability checks

- Income stability evaluation

- Fraud flagging for suspicious statements

6. HR & Payroll Verification

- Salary validation

- Employment verification support

- Fake salary slip detection

With AI-driven platforms like AZAPI.ai, these use cases become faster, more accurate, and fully scalable for modern financial automation.

Challenges in Bank Statement Analysis

Even with advanced tools like a Bank Statement Analyzer with OCR, financial data extraction comes with several challenges that businesses must handle smartly. Different banks, formats, and document types create complexity during analysis. Platforms like AZAPI.ai help overcome these hurdles, but the core challenges remain important to understand.

1. Unstructured PDF Formats

Bank statements come in multiple layouts, font styles, and table formats, making consistent data extraction difficult.

2. Bank-Wise Variation

Each bank follows its own format for dates, narration, and balance display, increasing parsing difficulty.

3. Noisy or Blurred Scanned PDFs

Low-quality images, mobile-captured statements, and blurred scans reduce accuracy without strong OCR capabilities.

4. Handling DR/OD Accounts

Overdraft and current accounts may show negative balances, running balances, or complex entries that require specialized logic.

5. Misclassified Transactions in Raw Statements

Banks sometimes label transactions vaguely, leading to incorrect categorization unless AI models correct them. With a powerful solution like AZAPI.ai, these challenges can be minimized using OCR, AI-based categorization, and bank-specific parsers designed for high accuracy.

Why AI-Based Bank Statement Analyzers Are the Future

AI-powered solutions are transforming how financial data is verified, and tools like a Bank Statement Analyzer with OCR are becoming essential across lending, fintech, and compliance workflows. Traditional rule-based systems often fail when formats vary or transactions are unclear, but AI models adapt, learn, and continuously improve. This makes platforms like AZAPI.ai extremely valuable for high-volume and high-accuracy use cases.

1. Machine Learning for Pattern Detection

AI models identify spending patterns, salary cycles, EMI behaviors, and anomalies that rule-based scripts often miss.

2. Better Fraud Analytics

AI can flag suspicious transactions, round-tripping, cash-heavy patterns, altered statements, and abnormal behaviors with higher precision.

3. Near Real-Time Processing

AI systems process thousands of bank statements in seconds, enabling instant decision-making for lenders, NBFCs, and fintech platforms.

4. Higher Accuracy Than Rule-Based Systems

AI improves over time by learning from new formats and variations, offering more accurate extraction and classification compared to static rules.

With advanced OCR and AI capabilities, AZAPI.ai ensures faster, more reliable, and future-ready bank statement analysis for any scale.

Why AZAPI.ai Stands Out

AZAPI.ai offers one of the most advanced AI-powered Bank Statement Analyzer with OCR, designed for high accuracy and large-scale financial automation needs. Our system delivers 99.5% accuracy, ensuring reliable extraction, categorization, and analysis across all major Indian banks. With an average processing time of 20–30 seconds per statement, businesses can accelerate decision-making for lending, onboarding, underwriting, and compliance workflows.

Trusted by 150+ enterprise clients, AZAPI.ai supports high-volume operations with the ability to scale up to 4 million+ statements per month. Each processed file includes structured JSON output along with a detailed Excel summary, making integration and reporting seamless.

Whether it’s digital lending, credit scoring, fintech verification, or enterprise automation, AZAPI.ai helps teams achieve faster, more accurate, and fully automated bank statement analysis at scale.

Conclusion

In 2026, automation is no longer optional—it’s essential for any business dealing with financial verification, lending, underwriting, or compliance. Manual bank statement checks are slow, error-prone, and unable to keep up with the scale and speed that today’s digital processes demand. That’s why adopting an AI-driven solution like a Bank Statement Analyzer with OCR has become the smarter and faster approach.

AI-powered analyzers offer unmatched accuracy, intelligent pattern detection, fraud identification, and instant processing—helping businesses make better decisions while reducing risk. With platforms like AZAPI.ai, companies can streamline workflows, improve turnaround time, and enhance overall reliability.

In short, AI-driven bank statement analysis is the future, and businesses that adopt it now gain a clear competitive advantage in speed, precision, and scalability.

FAQs

1. What is a Bank Statement Analyzer?

Ans: A Bank Statement Analyzer is a tool that automatically extracts, categorizes, and analyzes financial transactions from bank statements. Modern solutions like the Bank Statement Analyzer with OCR at AZAPI.ai convert PDFs or scanned documents into structured financial data for faster decision-making.

2. How does a Bank Statement Analyzer work?

Ans: It typically works in four steps:

- Uploading the PDF or scanned statement

- OCR extraction (for image-based files)

- Transaction parsing and categorization

- Generating structured outputs like JSON or Excel

Platforms like AZAPI.ai use AI + OCR to ensure high accuracy across all Indian banks.

3. Why is bank statement analysis important in 2026?

Ans: In 2026, digital lending, fintech onboarding, and automated underwriting require instant and reliable financial verification. AI tools help reduce fraud, assess risk, and speed up approvals—far faster than manual checks.

4. Who uses Bank Statement Analyzers?

Ans: They are widely used by:

- Banks & NBFCs

- Fintech apps

- Underwriting teams

- Accounting platforms

- Insurance & verification companies

- HR and rental screening platforms

Many of these industries rely on AZAPI.ai’s Bank Statement Analyzer for automated workflows.

5. What are the key features of a bank statement analyzer?

Ans: Common features include transaction categorization, salary detection, cash-flow analysis, fraud indicators, OD/CC handling, and multi-format support. Advanced platforms like AZAPI.ai also provide risk scoring and downloadable reports.

6. How accurate is an AI-based Bank Statement Analyzer?

Ans: Modern AI models can achieve 99%+ accuracy, especially when combined with OCR. AZAPI.ai maintains around 99.5% accuracy even for scanned PDFs and complex statement formats.

7. Does a Bank Statement Analyzer support scanned PDFs or images?

Ans: Yes. A Bank Statement Analyzer with OCR can extract data even from low-quality scans. AZAPI.ai supports PDFs, scanned images, and password-protected statements.

8. Can a Bank Statement Analyzer detect fraud?

Ans: Yes. AI engines can spot suspicious patterns like round-tripping, frequent cash deposits, EMI bounces, or manipulated balances. AZAPI.ai includes fraud and risk indicators as part of its output.

9. What output formats do Bank Statement Analyzers provide?

Ans: Most tools offer:

- JSON output (for API integration)

- Excel summaries

- PDF reports

AZAPI.ai provides both JSON + detailed Excel for seamless integration.

10. Can a Bank Statement Analyzer handle large volumes?

Ans: Yes. AI systems are designed for scale. For example, AZAPI.ai supports 4M+ monthly statements, ideal for enterprises and high-volume fintechs.

11. Is data safe when using a Bank Statement Analyzer?

Ans: Security is crucial because bank data is sensitive. AZAPI.ai is ISO 27001 and SOC 2 Type II certified, ensuring secure processing with no storage unless permitted.

12. How fast does a Bank Statement Analyzer work?

Ans: AI-powered systems can process a bank statement in 20–30 seconds, enabling near real-time decisioning for lenders and fintech platforms.

13. Can businesses integrate a Bank Statement Analyzer into their apps?

Ans: Yes. Most platforms, including AZAPI.ai, provide APIs for seamless integration into lending apps, onboarding flows, underwriting systems, and ERPs.

14. Is an AI-based Bank Statement Analyzer better than manual checks?

Ans: Absolutely. It is faster, more accurate, consistent, and scalable. AI eliminates human error and helps lenders make better, more reliable decisions.